Homeownership out of reach for many income levels

Last week, we wrote about the affordability of rental housing and the fact that we’ve all seen property values drop in recent years, but...

1 min read

Twin Cities Habitat for Humanity

:

11:16 AM on July 13, 2012

Twin Cities Habitat for Humanity

:

11:16 AM on July 13, 2012

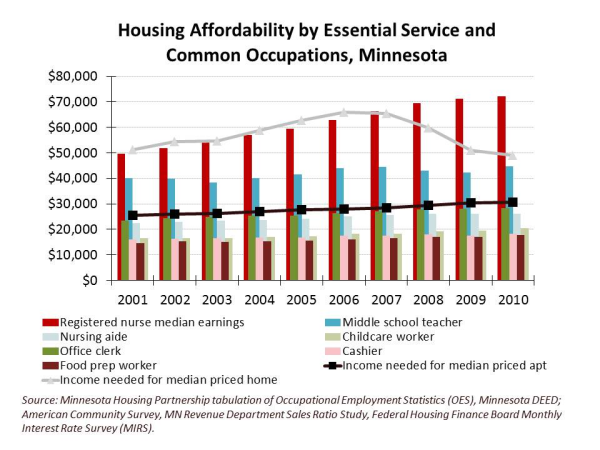

The Center for Housing Policy has released a new report updating its Paycheck to Paycheck database, which presents wage information for more than 70 occupations and home prices and rents for more than 200 metropolitan areas. This year’s report demonstrates home prices are actually going up in many metropolitan areas—and even in communities where prices have fallen, housing still costs more than what many jobs pay.

The Center for Housing Policy has released a new report updating its Paycheck to Paycheck database, which presents wage information for more than 70 occupations and home prices and rents for more than 200 metropolitan areas. This year’s report demonstrates home prices are actually going up in many metropolitan areas—and even in communities where prices have fallen, housing still costs more than what many jobs pay.

As expected in the current economy, many communities saw a slight drop in cost to own a home in 2012. For more than 70 percent of the metro areas studied, the income needed to buy a median-priced home dropped three percent or more in the last year.

However a significant number of communities run counter to this trend. In 21 of the studied metro areas, the income needed to afford a median-priced home increased by three percent, while in eight of the studied areas, there was an increase of 10 percent or more.

Minneapolis/St. Paul saw a 6 percent decrease in income required to purchase a median-priced home. The 2011 median home price was $160,000 and the qualifying income to afford a median-priced home was $47,377. In 2012 the median home price dropped to $158,000 and the qualifying income to $44,621.

If you liked this post, see our Housing News section for more articles.

Shari Hemmingsen, Housing Matters! Intern, and Jill Kilibarda, Education and Civic Engagement Program Manager, Twin Cities Habitat for Humanity

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Last week, we wrote about the affordability of rental housing and the fact that we’ve all seen property values drop in recent years, but...

2020 was challenging, to say the least, and the Twin Cities housing market changed rapidly to keep up. While the world navigates an ever-evolving...

If you are planning to buy your first home in 2020, there is a lot to learn about the market! With a pandemic, recession, and social distancing...