7 Mortgage Mistakes to Avoid When Buying Your First House

Having a good understanding of basic real estate concepts will help you feel confident in the choices you make when buying your first house. You will...

If you’re considering buying a home, it might be time to understand a mortgage. Taking on a mortgage can be intimidating, but you’ll be better prepared if you know what’s in your payment. The acronym PITI is a simple way to remember the elements of most mortgage payments: Principal, Interest, Taxes, and Insurance.

If you’re considering buying a home, it might be time to understand a mortgage. Taking on a mortgage can be intimidating, but you’ll be better prepared if you know what’s in your payment. The acronym PITI is a simple way to remember the elements of most mortgage payments: Principal, Interest, Taxes, and Insurance.

Principal is the actual amount of your loan. The principal payment each month reduces the size of the loan. With each dollar you contribute toward your principal payment, you earn a dollar of equity in your home.

Interest is the cost of borrowing money and is a percentage of the total principal balance. Interest varies based on the market, the lender, and the borrower's credit worthiness.

What is a good interest rate for a first home, anyway?

Your mortgage payment also includes property taxes, which are based on where you live and the value of your property. Property taxes are determined by your county and are paid to your county.

Most mortgage lenders require homeowner’s insurance, but even when it’s not required, it’s a good idea to have it. Homeowner’s insurance protects you in case of damage to or loss of your home. As the borrower, you determine from which company you'd like to buy your homeowner's insurance policy.

Taxes and insurance are both part of a borrower's escrow. Escrow refers to items that are required in the mortgage payment but aren’t earned by the mortgage lender. The mortgage lender simply collects these fees from the borrower, then pays them out to the other third parties on the borrower's behalf (taxes to the county; insurance to the insurance company).

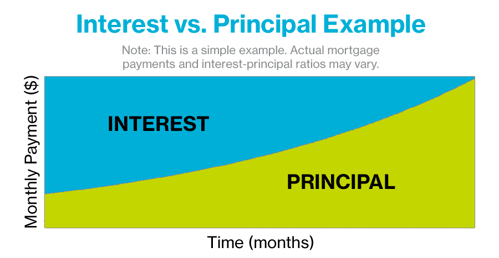

With a fixed-interest mortgage, the sum of your principal and interest payment remains the same over the term of the mortgage, but the ratio between them changes. At the beginning of a mortgage, interest is a big portion of the monthly payment and principal is much smaller. Over time, as the total principal balance is reduced, the ratio changes—more of the monthly payment goes toward principal and less goes toward interest. See the diagram for a depiction of this change.

While the sum of your principal and interest payment stays constant over the life of the mortgage, your taxes and insurance payment may fluctuate. This will change based on any local property tax variations, changes to the value of your property, or adjustments to your insurance plan.

Partnership with Habitat is one way to buy a home with an affordable mortgage. Habitat mortgages are originated through TCHFH Lending Inc., a nonprofit mortgage subsidiary of Twin Cities Habitat for Humanity. They are all fixed-rate, long-term mortgages.

A Habitat mortgage includes the four elements described above, plus one more piece: savings for the Maintenance Fund. Habitat homebuyers contribute to the Maintenance Fund with each monthly mortgage payment to save for home maintenance and improvements.

All Habitat mortgages are affordable: the combination of the five mortgage elements add up to no more than 30% of the homebuyers’ income.

Buying a home is one of the best moments in life. Don’t let the complexity of a mortgage scare you off. Just remember PITI: Principal, Interest, Taxes, and Insurance.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Having a good understanding of basic real estate concepts will help you feel confident in the choices you make when buying your first house. You will...

Buying a home is an exciting experience, especially if it's your first time. If you've never taken out a home loan, it's perfectly normal to be...

Shopping for your first homeis an exciting experience. After all, it's the first place you can call your own! While finding a house that you're happy...