Foreclosure prevention program helps resident save home

Boarded up windows, (sheriff’s notice taped to a door), abandoned houses, empty neighborhoods – we all know the signs of foreclosure in our...

Joyce Johnson was living the American Dream. Married with three children and another child on the way, Joyce had a great job and was the proud homeowner of a beautiful early 1900's South Minneapolis home.

In the Spring of 2006, everything changed. Johnson's high-risk pregnancy put her on bed rest and on early maternity leave from her job. Just after she had her baby, her company announced it was moving headquarters out of the Twin Cities and she got her pink slip. A month later, she faced major surgery on both feet. What doctors told her would be a four week recovery turned into almost five months.

"It all happened in the blink of an eye," said Johnson.

Securing employment proved a significant challenge, and the meager unemployment checks simply weren't enough to cover her family's bills. Fiercely proud of her good credit rating, Joyce fought hard to stay afloat. "I cashed out my 401k and tapped into my savings," she said.

But by January 2007, her reserves were drying up. She turned to emergency assistance and community based programs for help. "Nothing helped long term, and I was getting further and further behind," she said.

In May, she received the letter announcing foreclosure proceedings, with a scheduled sheriff's sale. "There is nothing worse than seeing the house you have owned for 13 years listed in the newspaper under a sheriff's auction," said Johnson.

She ramped up her search for employment and her search for help. African American Family Services referred her to Twin Cities Habitat for Humanity's Mortgage Foreclosure Prevention Program (MFPP). About the same time she received a call for a job interview and was offered employment.

Through Twin Cities Habitat's MFPP program, Johnson was able to secure a loan modification. "It was so helpful to have Twin Cities Habitat as a third party to help negotiate the terms. When you are stressed out and worried about keeping your home, it's nice to have someone there to look at the fine print and help you understand."

Under her loan modification, the delinquent amount of Johnson's mortgage was added to the principal amount, and the loan terms were kept intact. As a result, her payments went up only $20 per month.

"Joyce did a lot on her part to rectify the situation. She just needed someone to step in and help with negotiation. Persistent communication and follow up with lenders is critical to coming up with a solution. Working homeowners that are struggling to pay the bills often don't have that luxury of time to sit on hold for hours. That's where our team can help," said Melissa Hansen, Mortgage Foreclosure Prevention Counselor for Twin Cities Habitat for Humanity.

"In the end, Joyce's good credit history with the mortgage company, her ability to secure employment, and the fact that her hardships had been resolved contributed to her successful outcome. She just needed that extra help from us to help negotiate the final terms," added Hansen.

Knowing that her family's house was saved from foreclosure, Johnson can finally relax. Looking out of her kitchen window, she watches her son Jaylon bounce a basketball in the backyard. "It's the only home my kids have known," she said. There is a bustling energy in the house as the family prepares for their neighborhood's National Night Out celebration. Johnson smiles as she explains, "we go every year."

Contributed by Sharon Rolenc

Photo by Sharon Rolenc

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

Boarded up windows, (sheriff’s notice taped to a door), abandoned houses, empty neighborhoods – we all know the signs of foreclosure in our...

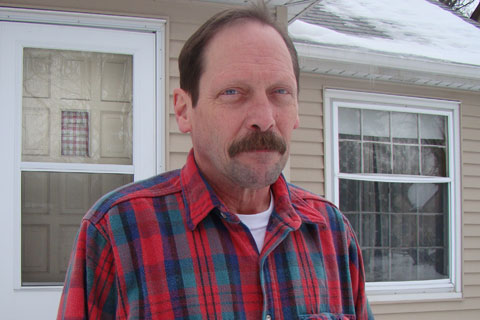

With all the negative news out there about foreclosures here’s one bright spot – Kelly Behrendt is going to keep his South Minneapolis home, and he...

Twin Cities Habitat for Humanity’s Mortgage Foreclosure Prevention Program (MFPP) is happy to be participating in the Making Home Affordable...