Collections, Charge Offs, and Judgments: What They Are and How to Get them Resolved

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...

2 min read

Twin Cities Habitat for Humanity

:

9:10 AM on March 18, 2023

Twin Cities Habitat for Humanity

:

9:10 AM on March 18, 2023

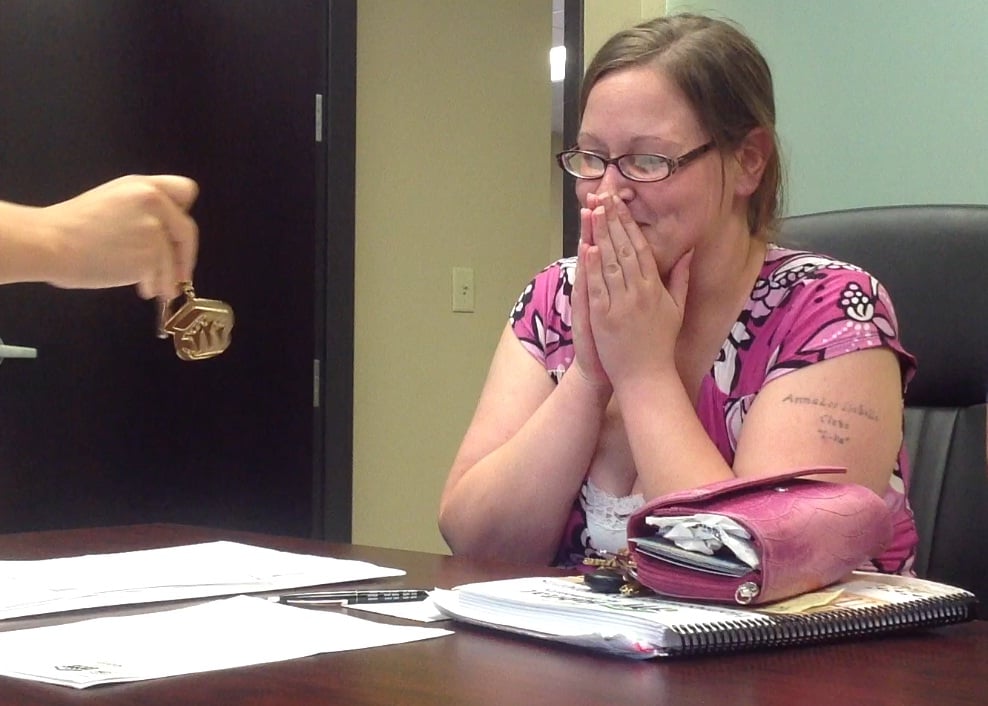

Since buying a home is a big (and exciting!) investment, many people have questions surrounding the financial part of the process. Whether it’s, “Can I take out a personal loan to cover a house downpayment?” or “How much should I put aside for annual house maintenance?” There are a lot of important questions to be asked.

A common question we hear is, "Can I buy a home if I have collections on my credit report?" Fortunately, the answer is yes. But it depends on how much money you owe and what type of debt it is.

Here are some things you should know if you have collections but want to buy a home.

Mortgage lenders expect you to have some debt, almost everyone does. To them, it's more important to know what type of debt you have, how much you owe, and whether you are making regular payments on your debts. They also want to know if you have any “derogatory credit.”

Derogatory credit includes, among other types, “collections” and “charge-offs”:

Charged-off debt is not forgiven and will show up on your credit report for seven years. Lenders may also sell charge-offs to collection agencies who may try to collect the debt until the statute of limitations runs out in your state.

All lenders have a limit for the amount of money in collections they allow a borrower to have. Traditional lenders may not work with a borrower who has any collections on their credit report. But there are exceptions.

A lender may ask a borrower to prove that a certain amount in collections has already been paid or prove that a repayment plan was created. Other lenders may be more flexible. For example, with a TruePath Mortgage, a person is allowed to have up to $1,000 in non-medical collections and still be eligible for a loan. Medical collections do not impact eligibility.

Lenders look at your credit report to see what significant monthly debts you have, including collections and charge-offs. Using these figures, they calculate your debt-to-income ratio (DTI). A good rule of thumb is to aim for a DTI of around 36%.

Your DTI allows the lender to evaluate how much you can afford to borrow considering the payments you need to make on a regular basis. Most lenders want a borrower to have a DTI below 43%.

With exceptions, your lender may require you to pay off any collections and charge-offs on your credit report. Even if your DTI is within a healthy range, the loan officer may indicate collection items are delaying loan approval.

This can feel overwhelming at first, but there are professionals out there who can help you get a grasp on what you have, what you owe, and what you can afford. For instance, Twin Cities Habitat for Humanity financial coaches can help you build a budget, set up payments for your collections, and increase your credit score.

Regardless of what a lender requires, you can start to strengthen your financial situation now. Pull a free credit report as soon as you think about buying a home. This will help you understand where you are financially and give you time to create a plan to improve your finances if you need to.

Your gift unlocks bright futures! Donate now to create, preserve, and promote affordable homeownership in the Twin Cities.

We continue to process the pain and hope of our nation’s uprising for racial justice amid a global health crisis. You can see ourrecent statements...

Understanding key financial terms is essential for first-time homebuyers (and anyone else getting ready to borrow money from a lender). Knowing what...

So, you've got your eye on a house. It's a three-bedroom, two-bathroom, split-level home in a safe and friendly neighborhood. It's everything you've...